In this weekly newsletter, I will cover:

Market Overview

Layer 1 / 2 Performances

DEX Metrics

Defi News / Protocol updates

Analysis / Insights

Yield Farming Opportunities

Market Overview

Another bloody week. After the 8.6% historically high CPI figure released, the Federal Reserve raised its target interest rate by 75 basis points on Wednesday, which would be the biggest since 1994.

Some of the mining machines have already reached to the “Shut Down” Price. It is worried that miners may have to shut down their operations and started to sell off their machines and BTC.

Miner capitulation was confirmed on the Hash Ribbon indicator., where the 30-day MA moves below the 60-Day MA, it indicates that miners are leaving in large numbers.

Another hot topic discussed around crypto community was the Three Arrows Capital (3AC) drama. 3AC was rumored to be insolvent where 3AC were selling their steth positions consistently and reduced all AAVE positions. Moreover, Danny Yuan, the chief executive of market maker 8 Blocks Capital, tweeted that 3AC took about 1m out of their accounts. You may refer to @thedefiedge’s thread for more details.

Under the current brutal market, lots of protocols / companies seems having trouble. MIM and USDD is depegging and centralized institutions face liquidity problem as well (such as Definance Capital, Babel Finance & Hoo exchange) It is expected more is coming and the market will remain volatile.

Layer 1 / 2 Performances

(Source: https://cryptofees.info/)

Top 10 chains 7 Day Avg. Fees: -28.6% (down from 10.5M to 7.5M)

DEX Metrics

(Source: https://dune.com/hagaetc/dex-metrics)

DEX 7 days Volume: +78% to $30B

Defi News / Protocol updates

1. 500 million USDC more to defend the USDD peg

2. 3AC in trouble?

3. 3AC drama

4. Celsius start paying back the debt on chain

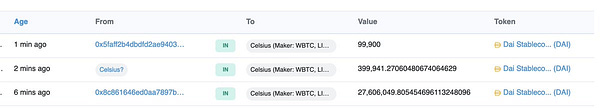

5. MIM insolvent?

6. MakerDao adding reth as a new collateral type

7. Aura live!

8. Maker has voted to temporarily disable the D3M

9. Bancor paused all impermanent loss protection due to market conditions

10. Babel suspends withdrawal

11. Hoo exchange suspends withdrawal too

Analysis / Insights

Improving tokenomics of Link

2. Will CRV & CVX go to zero?

3. Is USDD safe now?

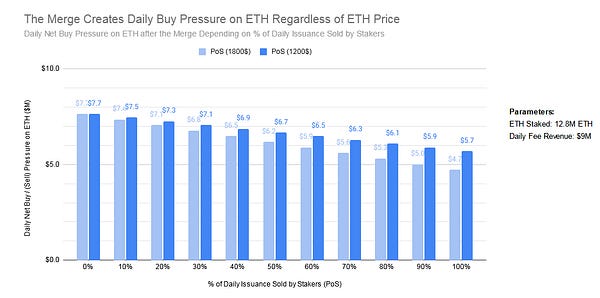

4. How does ETH price affect the daily buy/sell pressure

5. Celsius blowup explanation

6. Synthetix ecosystem overview

7. Valuing FEI

8. 9 great threads for preparing the next bull market

Yield Farming Opportunities (DYOR)

ETH:

USDN-3pool @Convex Finance 41.08%

PUSD-3pool @Convex Finance 18.73%

DAI-USDC-USDT-sUSD @Convex Finance 29.07%

USDC @cbridge 20.9%

NEAR:

USN-USDT @Ref Finance 14.34%

USDT / USDC @Burrow ~8%

AVAX:

YUSD @Vector Finance 10.5%

That’s all I want to share with you guys! If you enjoyed reading it or found something useful, please subscribe and share:)